Trading Made Simple: A Professional’s Guide to Market Success

Cut through the noise. Master the essentials. Start profiting.

What is Trading and How Does it Work?

Trading is buying and selling financial assets to make money from price changes. You buy low, sell high. That’s it.

The process is simple : You analyze the market, spot an opportunity, place a trade, and close it for profit. Modern trading happens electronically through brokers who connect you to global markets.

Three types dominate : day trading (buying and selling within hours), swing trading (holding for days or weeks), and position trading (months to years). Each requires different skills and time commitments.

Markets never sleep. While you sleep, Tokyo trades. While Tokyo sleeps, London opens. This creates endless opportunities for those who know what they’re doing.

Trading for Beginners: Start Right or Don’t Start

Most beginners fail because they skip the basics. Don’t be most beginners.

The Non-Negotiables:

- Learn before you earn

- Start with demo accounts (fake money)

- Master one strategy before trying another

- Never trade money you need for rent

First Steps:

- Pick one market (stocks, forex, or crypto)

- Choose a reliable broker

- Practice for at least 3 months

- Start with small real money trades

- Track every trade and learn from mistakes

The market will teach you humility quickly. Accept this. The faster you learn, the faster you’ll improve.

Choose Your Trading App Wisely

Your trading app is your weapon. Choose wrong, and you’re fighting with broken tools.

Essential Features:

- Fast execution (delays cost money)

- Real-time price data

- Basic charting tools

- Low fees and tight spreads

- Strong security and regulation

Popular choices include MetaTrader 4, eToro, and Plus500. Each has strengths. MetaTrader offers advanced tools. eToro provides social trading. Plus500 keeps things simple.

Test the app’s speed during market hours. If it lags when you need to trade, find another one.

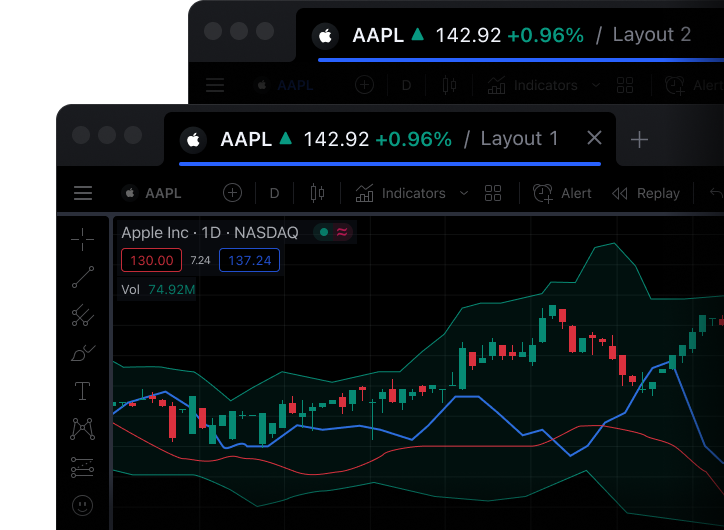

TradingView: The Chart Master’s Choice

TradingView changed how traders analyze markets. It’s free, powerful, and used by professionals worldwide.

Why Pros Use TradingView:

- Best trading charts available online

- Thousands of technical indicators

- Share ideas with other traders

- Works on any device

- Integrates with many brokers

The learning curve is gentle. Start with basic candlestick charts. Add moving averages. Learn support and resistance. Master these before adding complex indicators.

Pro tip: Follow successful traders on TradingView. Study their analysis. Learn their thought process.

Trading Formation: Build Skills That Last

Trading formation means continuous learning. Markets evolve. Successful traders evolve with them.

Core Skills to Develop:

- Chart reading and pattern recognition

- Risk management (most important)

- Market psychology understanding

- Strategy development and testing

- Emotional control under pressure

Learning Path:

- Week 1-4: Market basics and terminology

- Month 2-3: Technical analysis fundamentals

- Month 4-6: Strategy development and testing

- Month 7+: Live trading with small amounts

Books help. Courses help. But practice with real money teaches lessons no book can.

Trading Forex: The Currency Game

Trading forex means exchanging currencies for profit. The EUR/USD pair, for example, shows how many US dollars buy one Euro.

Forex Advantages:

- Open 24/5 (Monday to Friday)

- High liquidity (easy to buy and sell)

- Start with small amounts

- Profit from rising or falling currencies

Major Pairs to Know:

- EUR/USD (most traded)

- GBP/USD (volatile, good for day trading)

- USD/JPY (stable, good for beginners)

Economic news drives forex. Employment reports, inflation data, and central bank decisions create trading opportunities. Learn the economic calendar.

Platform Access: Secure Your trading.com Login

Whether using trading.com login or any platform, security matters. Hackers target trading accounts because they contain money.

Security Basics:

- Use unique, strong passwords

- Enable two-factor authentication always

- Never trade on public WiFi

- Log out completely after each session

- Monitor account activity weekly

If something looks wrong, contact support immediately. Every minute counts when your money is at risk.

How Do I Start Trading? The Professional Way

Step 1: Choose Your Market Focus on one. Stocks if you like companies. Forex if you prefer currencies. Crypto if you can handle volatility.

Step 2: Learn the Basics Understand how your chosen market works. What moves prices? When does it open and close? What are the costs?

Step 3: Practice First Use demo accounts. They simulate real trading without risk. Practice until you’re consistently profitable for at least two months.

Step 4: Go Live Carefully Start with the minimum amount possible. Many brokers allow $100 accounts. Perfect for learning without major losses.

Step 5: Scale Gradually Only increase trade sizes after proving consistent profitability. Rush this step, and you’ll lose money fast.

Real Talk: How Much Can You Make Day Trading with $1000?

Here’s the truth most won’t tell you: most day traders lose money.

Realistic Expectations:

- Professional traders target 10-20% monthly returns

- With $1000, that’s $100-200 per month maximum

- Subtract fees, taxes, and living expenses

- Bad months will happen (sometimes many in a row)

The Math: Even a 2% daily return (very optimistic) equals $20 per day before costs. Broker fees, spreads, and taxes reduce this significantly.

Better approach: Focus on learning and consistent small profits. Build your account slowly. Compound returns over time.

Reality Check: If day trading with $1000 could reliably generate significant income, everyone would do it.

Risk Management: Keep Your Money Safe

Risk management separates professionals from gamblers. Follow these rules religiously:

The 2% Rule: Never risk more than 2% of your account on one trade. With $1000, that’s maximum $20 risk per trade.

Stop Losses: Always use them. Set your loss limit before entering any trade. Stick to it no matter what.

Position Sizing: Smaller positions mean smaller losses. You can always add to winning trades.

Diversification: Don’t put all money in one trade or market. Spread the risk.

Break these rules, and the market will break you.

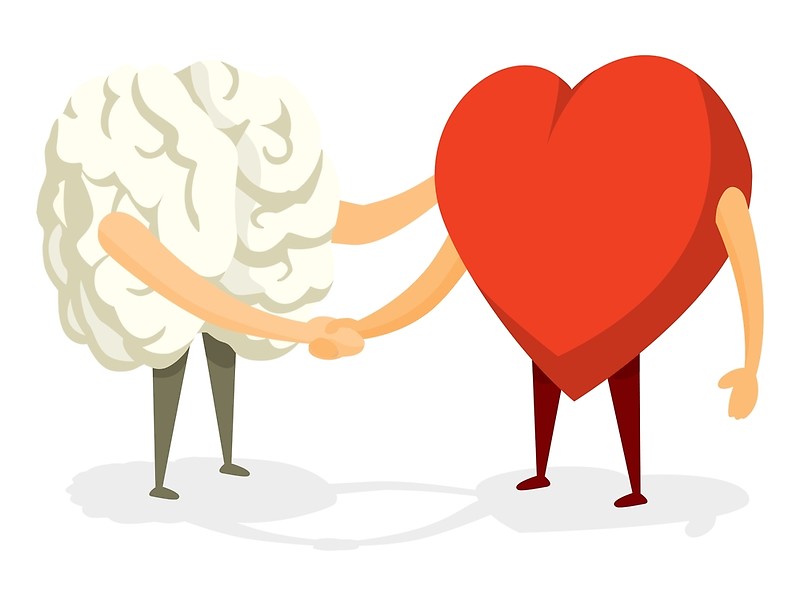

Trading Psychology: Control Your Mind

Your biggest enemy isn’t the market. It’s you.

Common Psychological Traps:

- Revenge trading after losses

- Moving stop losses when losing

- Taking profits too early from fear

- Holding losing trades too long from hope

Professional Mindset:

- Treat each trade independently

- Focus on process, not individual results

- Accept losses as business expenses

- Stay calm during both wins and losses

Successful traders think in probabilities, not certainties. They know that losses are part of the business.

Trading Traduction: Global Market Access

Trading traduction – understanding markets in different languages and cultures – gives you an edge. Economic news breaks worldwide. Sometimes the best analysis comes from local sources.

Learn to read key financial terms in major languages. Use translation tools for foreign economic reports. This broader perspective often reveals opportunities others miss.

Simple Strategies That Work

Strategy 1: Trend Following Buy when price moves up. Sell when it moves down. Use moving averages to identify trends. Simple but effective.

Strategy 2: Support and Resistance Buy near support levels (where price typically bounces up). Sell near resistance levels (where price typically bounces down).

Strategy 3: Breakout Trading Trade when price breaks above resistance or below support. These moves often continue strongly.

Start with one strategy. Master it completely before learning others.

Building Your Trading Business

Treat trading like a business because that’s what it is.

Business Requirements:

- Keep detailed records of all trades

- Track performance metrics monthly

- Set aside money for taxes

- Have a written trading plan

- Review and adjust strategies regularly

Performance Metrics:

- Win rate (percentage of profitable trades)

- Average win vs. average loss

- Maximum drawdown (largest losing streak)

- Return on investment

Technology and Tools

Modern trading requires modern tools:

Essential Software:

- TradingView for analysis

- Economic calendar for news

- Position size calculator

- Trading journal for record keeping

Hardware Needs:

- Reliable internet connection

- Fast computer or smartphone

- Backup power supply for critical trades

Don’t overcomplicate. Simple tools used well beat complex tools used poorly.

Common Mistakes to Avoid

Fatal Errors:

- Trading without a plan

- Ignoring risk management

- Chasing losses with bigger trades

- Trading based on emotions

- Not keeping records

Expensive Mistakes:

- Overtrading (trading too frequently)

- Using too much leverage

- Not understanding fees and costs

- Following other people’s trades blindly

Learn from other people’s mistakes. It’s cheaper than making your own.

The Path Forward

Trading success comes from:

- Proper education and continuous learning

- Strict risk management discipline

- Emotional control under pressure

- Realistic expectations about returns

- Treating it as a serious business

The market rewards patience, discipline, and consistency. It punishes greed, fear, and recklessness.

Start small. Learn constantly. Risk little. Think long-term.

Your trading journey begins with a single step. Make sure it’s in the right direction.

Post Comment