Money Tools You Can’t Live Without in 2025: Top Apps, Platforms, and Services to Take Control of Your Finances

Managing your money has never been easier—or more important. In 2025, smart financial tools are changing how we save, spend, and invest, helping millions take control of their financial future.

The Financial Revolution is Here

Let’s face it: managing your finances used to be a headache. Endless spreadsheets, manually tracking expenses, trying to remember bill due dates—it was a lot. But 2025 is different. Thanks to powerful, intelligent financial apps, managing your money is becoming more automatic, smarter, and even kind of enjoyable. These tools don’t just help you keep track; they act like your personal finance assistant, working around the clock to make sure your money is working for you. Whether you want to grow your savings effortlessly, keep a close eye on your spending, or jump-start your investing journey, the right app can make all the difference.

Let’s dive into the best money tools you can’t live without this year.

1. Plum: Your AI-Powered Savings Sidekick

If you want to save more but hate thinking about it, Plum’s for you. It’s like having a financial advisor who’s always analyzing your spending and gently squirreling away small amounts into your savings without you noticing.

Why Plum is great:

- Uses AI to understand your income and expenses

- Automatically saves small amounts you won’t miss

- Average users save over £180 a month without effort

- Offers investment options for your growing savings

- Helps reduce bills by switching your utilities for you

Plum’s magic is how invisible it is—you hardly feel the money leaving your account, but your savings grow steadily.

2. Emma: Your Money Detective

Ever feel like money just disappears and you don’t know where? Emma connects to your bank accounts and reveals the hidden leaks, like those forgotten subscriptions or sneaky fees.

Emma’s highlights:

- Tracks all your spending across accounts

- Monitors subscriptions and helps cancel the ones you don’t use

- Gives personalized spending insights

- Suggests cheaper alternatives for your bills

- Alerts you about unusual transactions immediately

Many users are shocked at how much money they free up by cutting out forgotten subscriptions thanks to Emma.

3. Snoop: Your Personal Savings Coach

If you want practical, tailored advice instead of generic tips, Snoop’s a game-changer. It learns your unique habits and suggests realistic ways to save money that fit your lifestyle.

What Snoop does well:

- Analyzes your individual spending patterns

- Offers personalized money-saving tips

- Finds better deals on services you already use

- Gives actionable, achievable advice

Snoop helps you spot small wins that add up over time — the kind of coaching that feels personal, not preachy.

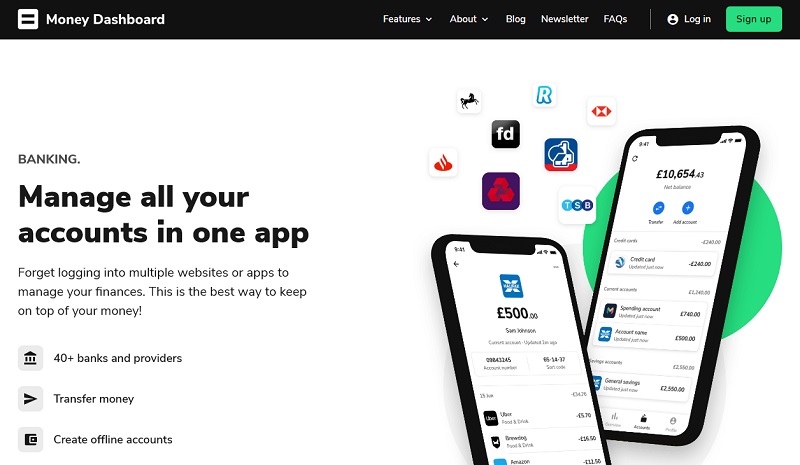

4. Money Dashboard: The Control Center for Your Money

If you have accounts with multiple banks, credit cards, or even investments, Money Dashboard helps you see everything in one place without juggling apps.

Why people love Money Dashboard:

- Combines all accounts into one clean interface

- Gives you tools for budgeting and planning

- Shows spending trends and where your money goes

- Forecasts your cash flow so you’re never caught off guard

Think of it as your financial command center, making complex money situations simple.

5. YNAB (You Need A Budget): For Budgeting Like a Pro

If you want serious control over your money and long-term financial success, YNAB is a must. It’s more than an app—it’s a way of thinking about money where every dollar has a job.

Why YNAB works:

- Helps you assign every dollar a purpose before you spend it

- Encourages living on money you already have

- Guides you in building emergency funds

- Helps plan for irregular or unexpected expenses

- Tracks progress toward your financial goals

Many users say YNAB helped them save hundreds within a few months—and break the paycheck-to-paycheck cycle.

6. Acorns & Qapital: Investing Made Easy

Want to start investing but don’t know where to begin? Acorns and Qapital make it painless by rounding up your purchases and investing the spare change.

What’s great about these apps:

- Automatically round up your daily spending

- Invest your spare change in diversified portfolios

- Let you set saving goals and custom rules (like “save $5 every time I skip takeout”)

- Provide beginner-friendly educational content

- Have no minimum investment requirements

It’s a simple, low-pressure way to build wealth without needing a finance degree.

7. PocketGuard & Rocket Money: Budgeting Without the Stress

For busy people who want budgeting without fuss, these apps show you exactly how much you can spend—after bills and savings are accounted for.

How they help:

- Calculate your real-time spending limit

- Help cancel unwanted subscriptions automatically

- Negotiate bills on your behalf (Rocket Money is great at this)

- Analyze your spending by category

- Make budgeting zero-stress and practical

It’s like having a money coach in your pocket.

Building Your Personal Financial Toolkit

The beauty of these apps is you don’t have to pick just one. Many people mix and match to cover different financial needs:

- Use Plum or Chime for effortless saving

- Emma or Money Dashboard for spending awareness

- Acorns or Qapital for easy investing

- YNAB or PocketGuard for budgeting mastery

The Future of Your Finances Starts Now

2025 is a turning point. These smart, automated tools aren’t just convenient—they’re becoming essential. Artificial intelligence, automation, and user-friendly design have leveled the financial playing field.

The real question isn’t if you need these tools, but which ones fit your goals and lifestyle best. Start with the one that tackles your biggest money challenge, then build your financial toolkit from there.

Your future self will thank you for starting today. These tools are powerful, ready, and waiting to help you build the financial life you deserve.

Ready to take control? Try one of these tools now and see how smart financial automation can change your life.

Post Comment