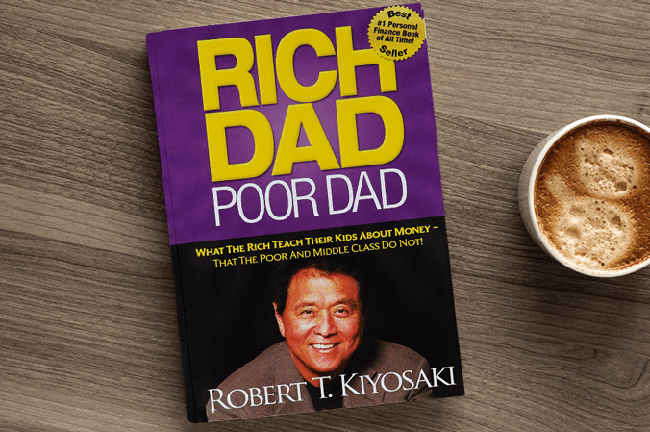

What “Rich Dad Poor Dad” Teaches Us About Money

Robert Kiyosaki wrote “Rich Dad Poor Dad” back in 1997, and it’s still one of the most popular money books today. The book tells the story of how two different dads taught him completely different things about money – and why one became rich while the other stayed poor.

Two Different Ways of Thinking

Kiyosaki had two father figures growing up. His real dad was smart, went to college, and had a good job. But he always worried about money. His friend’s dad didn’t finish school but became really wealthy. Kiyosaki calls them “Poor Dad” and “Rich Dad.”

Poor Dad always said things like “Go to school, get good grades, find a safe job.” He believed in working hard for someone else and saving money in the bank. Even though he made good money, he never seemed to have enough.

Rich Dad thought differently. He said “Don’t work for money – make money work for you.” Instead of just getting a job, he bought things that made him money while he slept.

The Big Secret: Assets vs. Liabilities

The most important lesson in the book is super simple but powerful. Rich Dad taught Kiyosaki that rich people buy assets, while poor and middle-class people buy liabilities but think they’re assets.

What’s an asset? Something that puts money in your pocket every month. What’s a liability? Something that takes money out of your pocket every month.

Most people think their house is an asset, but Kiyosaki says it’s actually a liability because you have to pay the mortgage, taxes, and repairs every month. A real asset would be a rental property where someone else pays you rent.

Why School Doesn’t Teach This Stuff

One thing that really bothered Kiyosaki was that schools don’t teach kids about money. We learn math, science, and history, but nobody teaches us how to invest, start a business, or understand taxes.

Rich Dad said the school system was designed to create good employees, not business owners or investors. That’s why so many smart people struggle with money – they never learned how money really works.

How Rich People Actually Get Rich

According to the book, wealthy people focus on buying things that make them money:

- Rental properties that bring in rent every month

- Stocks that pay dividends

- Businesses that run without them having to work every day

- Any investment that creates cash flow

Poor people focus on getting raises and saving money in low-interest bank accounts. Middle-class people buy bigger houses and fancier cars, which just take more money out of their pockets.

The rich get richer because their money makes more money. The poor and middle class work harder but never get ahead because they don’t own things that generate income.

Pay Yourself First

Rich Dad taught a simple rule: before you pay any bills, pay yourself first. This means putting money into investments before you spend it on anything else.

Most people pay all their bills first, then invest whatever’s left over (which is usually nothing). Rich people do it backwards – they invest first, then figure out how to pay their bills with what’s left. This forces them to find ways to make more money.

Getting Over Fear

The book talks about how fear stops people from building wealth. We’re afraid of losing money, so we keep it in “safe” places like savings accounts that barely pay any interest.

But Kiyosaki says the biggest risk is not learning about money. Inflation and taxes eat away at your savings anyway. The people who get rich are the ones who learn about investing and take smart risks.

What People Don’t Like About the Book

Not everyone loves “Rich Dad Poor Dad.” Some critics say:

- The advice is too simple and doesn’t work for everyone

- Not everyone can afford to buy rental properties

- Some of the examples seem unrealistic

- It doesn’t give enough specific steps to follow

Others question whether Rich Dad was even a real person, since Kiyosaki won’t say who he was.

Why the Book Still Matters

Even with its flaws, “Rich Dad Poor Dad” changed how millions of people think about money. Before reading it, most people believed the only way to wealth was getting a high-paying job and saving money.

The book opened people’s eyes to different possibilities: starting businesses, investing in real estate, or creating multiple streams of income. In today’s world, where job security isn’t guaranteed and prices keep going up, these ideas make even more sense.

The Bottom Line

“Rich Dad Poor Dad” isn’t a step-by-step guide to getting rich. It’s more like a wake-up call that makes you question everything you thought you knew about money.

The main message is simple: if you want to be wealthy, you need to own things that make you money, not just work for money. Whether you agree with all of Kiyosaki’s ideas or not, this basic concept has helped countless people start thinking differently about their financial future.

The book won’t make you rich by itself, but it might inspire you to start learning about investing, consider starting a side business, or at least think twice before buying things that don’t put money back in your pocket. And sometimes, that change in thinking is exactly what people need to start building real wealth.

Post Comment