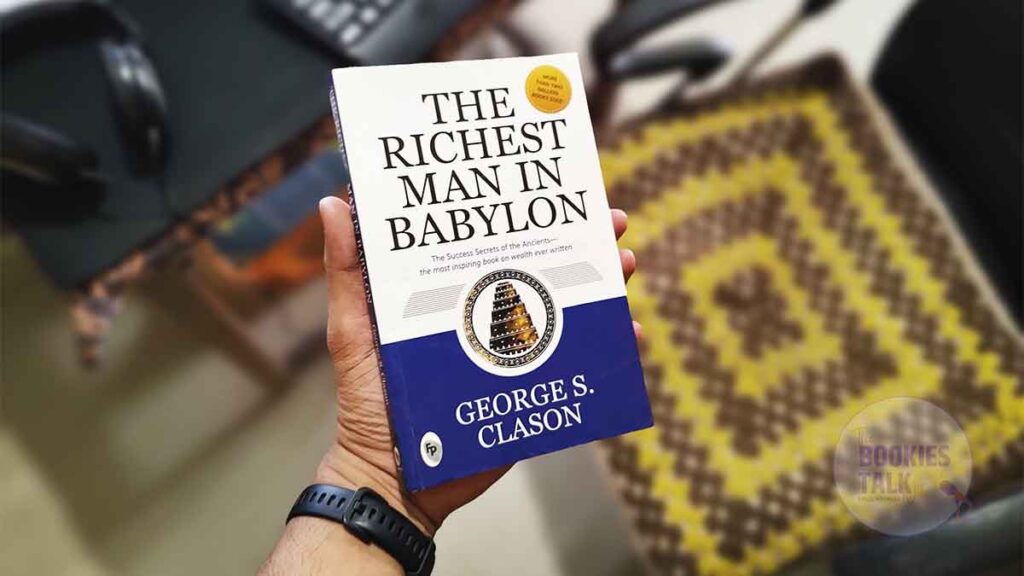

Book review : The Richest Man in Babylon

In a world obsessed with get-rich-quick schemes and complex investment strategies, George S. Clason’s “The Richest Man in Babylon” stands as a beacon of timeless financial wisdom. First published in 1926, this remarkable book has guided millions toward financial prosperity through simple, practical principles wrapped in engaging parables set in ancient Babylon.

The Core Idea: Ancient Wisdom for Modern Wealth

The genius of Clason’s approach lies in his use of ancient Babylonian setting to deliver universal financial truths. Rather than presenting dry financial advice, he crafts compelling stories featuring characters like Arkad, the richest man in Babylon, and his eager students seeking the secrets of wealth accumulation.

The book’s central premise is revolutionary in its simplicity: wealth building isn’t about complicated formulas or insider knowledge—it’s about following fundamental principles that have remained unchanged for thousands of years. Clason demonstrates that the path to riches lies not in earning more money, but in understanding how to keep, multiply, and protect what you earn.

Key Principles That Transform Lives

The Seven Cures for a Lean Purse

The book’s most famous section outlines seven fundamental rules for building wealth:

- Start thy purse to fattening – Save at least 10% of your income

- Control thy expenditures – Budget wisely and live below your means

- Make thy gold multiply – Invest your savings to generate passive income

- Guard thy treasures from loss – Protect your investments from risky ventures

- Make of thy dwelling a profitable investment – Own your home rather than rent

- Insure a future income – Plan for retirement and unexpected circumstances

- Increase thy ability to earn – Continuously improve your skills and knowledge

The Power of Compound Interest

Through the character of Arkad, Clason illustrates the magical power of compound interest. The book shows how consistent saving and wise investing, even with modest amounts, can create substantial wealth over time. This principle, often called the eighth wonder of the world, becomes accessible and understandable through Babylonian storytelling.

Why You Should Read This Book

Timeless Principles in an Ever-Changing World

Despite being written nearly a century ago, the book’s principles remain startlingly relevant. Market crashes, economic recessions, and technological disruptions may change the financial landscape, but the fundamental laws of wealth building remain constant. Whether you’re dealing with ancient gold coins or modern cryptocurrency, the core principles apply.

Simple Yet Profound

The beauty of “The Richest Man in Babylon” lies in its simplicity. Complex financial concepts are broken down into digestible stories that anyone can understand and apply. You don’t need an MBA or extensive financial knowledge to grasp these principles—just the wisdom to recognize truth when you see it.

Practical Application

Unlike many financial books that focus on theory, Clason provides actionable advice you can implement immediately. The 10% savings rule, for instance, is something you can start today, regardless of your current income level.

Psychological Foundation

The book addresses the psychological aspects of money management, helping readers understand why people struggle financially despite earning good incomes. It tackles the mindset shifts necessary for long-term financial success.

Memorable Quotes That Inspire Action

The book is filled with wisdom-packed quotes that have motivated readers for generations:

“A part of all I earn is mine to keep.” This simple statement forms the foundation of all wealth building, reminding us that paying ourselves first isn’t selfish—it’s essential.

“Advice is one thing that is freely given away, but watch that you take only what is worth having.” Clason warns against following financial advice from those who haven’t achieved financial success themselves.

“Gold cometh gladly and in increasing quantity to any man who will put by not less than one-tenth of his earnings to create an estate for his future and that of his family.” This quote encapsulates the entire philosophy of consistent saving and investing.

“Our acts can be no wiser than our thoughts. Our thinking can be no wiser than our understanding.” This highlights the importance of financial education and continuous learning.

“The hungrier one becomes, the clearer one’s mind works— also the more sensitive one becomes to the odors of food.” Applied to finances, this suggests that necessity often breeds innovation and determination.

The Enduring Legacy

What makes this book extraordinary isn’t just its financial advice—it’s the delivery method. By setting financial principles in ancient Babylon, Clason created a work that feels both authoritative and accessible. The parables format makes complex concepts memorable and shareable.

The book has influenced countless other financial authors and continues to be recommended by financial advisors, successful entrepreneurs, and wealth-building experts worldwide. Its principles form the foundation of most modern financial planning strategies.

A Book for Every Generation

“The Richest Man in Babylon” transcends age, culture, and economic circumstances. Whether you’re a recent college graduate drowning in student loans, a middle-aged professional looking to accelerate wealth building, or someone approaching retirement, the book’s lessons apply to your situation.

The stories resonate because they address universal human experiences: the desire for security, the fear of poverty, the dream of abundance, and the practical challenges of managing money in daily life.

Final Thoughts

In an era of information overload and conflicting financial advice, “The Richest Man in Babylon” offers clarity and direction. It strips away the complexity that often paralyzes people from taking action and presents a clear, proven path to financial success.

The book doesn’t promise overnight riches or miraculous transformations. Instead, it offers something more valuable: a solid foundation upon which to build lasting wealth. It teaches patience, discipline, and the power of consistent action—qualities that serve readers well beyond their financial lives.

Reading this book isn’t just about learning to manage money better; it’s about adopting a mindset that attracts and retains wealth. It’s about understanding that true riches come not from what you earn, but from what you keep, grow, and wisely invest.

For anyone serious about achieving financial independence and building generational wealth, “The Richest Man in Babylon” isn’t just recommended reading—it’s essential reading. Its lessons have stood the test of time because they’re built on fundamental truths about human nature and the principles that govern wealth creation.

Start your journey to financial wisdom today. Let the richest man in Babylon teach you the secrets that have created wealth for nearly a century.

Post Comment